Financial Banking Instrument

Financial instruments are financial contracts of different naturemade between institutional units. They are legal agreements that entail one party to pay money or something else of profit or to promise to pay under specified situations to counterparty in exchange for the payment of interest, for the possession of rights, for premiums, or for indemnification against risk. Financial asset is defined as any contract from which a financial claim may derive for one party and a financial liability or participation in equity for another. In exchange for the payment of the money, the counterparty hopes to profit by getting interest, capital gains, premiums, or compensation for a loss consequence.

A financial instrument can be an actual document, such as a stock certificate or a loan contract, but, gradually, financial instruments that have been regularized are stored in an electronic book-entry system as a record, and the parties to the contract are also recorded. For illustration, United States Treasuries are stored electronically in a book-entry system maintained by the Federal Reserve.

Some common financial instruments include:

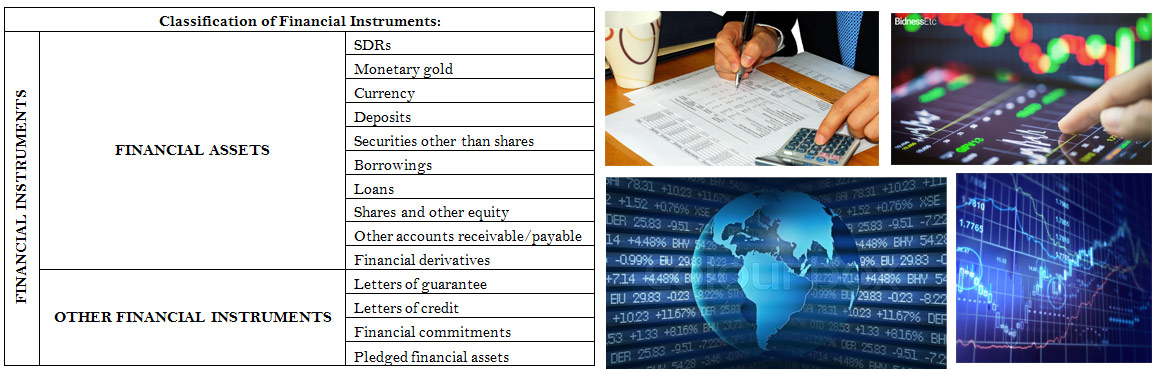

Check: They are used to transfer money from the payer, the writer of the check, to the payee, the recipient of the check. Stocks: They are issued by companies to raise money from shareholders. The investors pay for the stock, thereby giving money to the company, in exchange for an ownership interest in the company. Bonds: They are financial instruments that allow investors to lend money to the bond issuer for a specified amount of interest over a specified period.The concept of financial instrument is wider than the concept of financial asset as defined. Thus, financial instruments are classified into financial assets and other financial instruments.

Classification of financial assets is based on their two principal characteristics, liquidity and legal characteristics.There are many types of financial instruments. Many instruments are custom agreements that the parties modify to their own requirements. However, many financial instruments are based on regularized contracts that have predetermined characteristics.

These are the most common financial instruments which are prevailing in financial sector.

Valuation of Financial Instruments

The value of any financial instrument depends on how much it is expected to pay, the likelihood of payment, and the present value of the payment.Obviously, the greater the expected return of the instrument, the greater its value. This is why the stock of a fast-growing company is highly valued, for instance.

A financial instrument that has less risk will have a higher value than a similar instrument that has more risk—the greater the risk, the more it lowers the value of the security because risk requires compensation.

In the world of financial instrument and capital rising, Jupiter Corporation is a trusted corporation who can support their clients with the assistance required to raise capital for any venture. Whether they want capital to be raised through debt or through equity, whether for expand or for startup, Jupiter Corporation is their trusted Partner.